Blog

Menu

How U.S. Tariff Increases on China in 2025 Impact Cross-Border Sellers & Trade

In 2025, the U.S. increased tariffs on Chinese goods by 10%, posing significant challenges for both cross-border e-commerce sellers and traditional trade sellers. With rising tariffs, increased costs, supply chain adjustments, and market uncertainty have become critical issues that sellers need to address. How to cope with these changes, maintain profitability, and stay competitive in the global market is an urgent concern for sellers. In this blog, we will delve into the impact of tariff increases on cross-border e-commerce and trade sellers and provide practical response strategies.

1、Direct Impact of Tariff Increases

On February 1, 2025, the U.S. government announced a 10% tariff increase on Chinese goods. This policy directly leads to higher import costs, especially for cross-border e-commerce sellers and trade sellers who rely heavily on Chinese products in the global e-commerce supply chain. As procurement costs rise, sellers are under pressure to raise product prices, which consumers may ultimately bear.

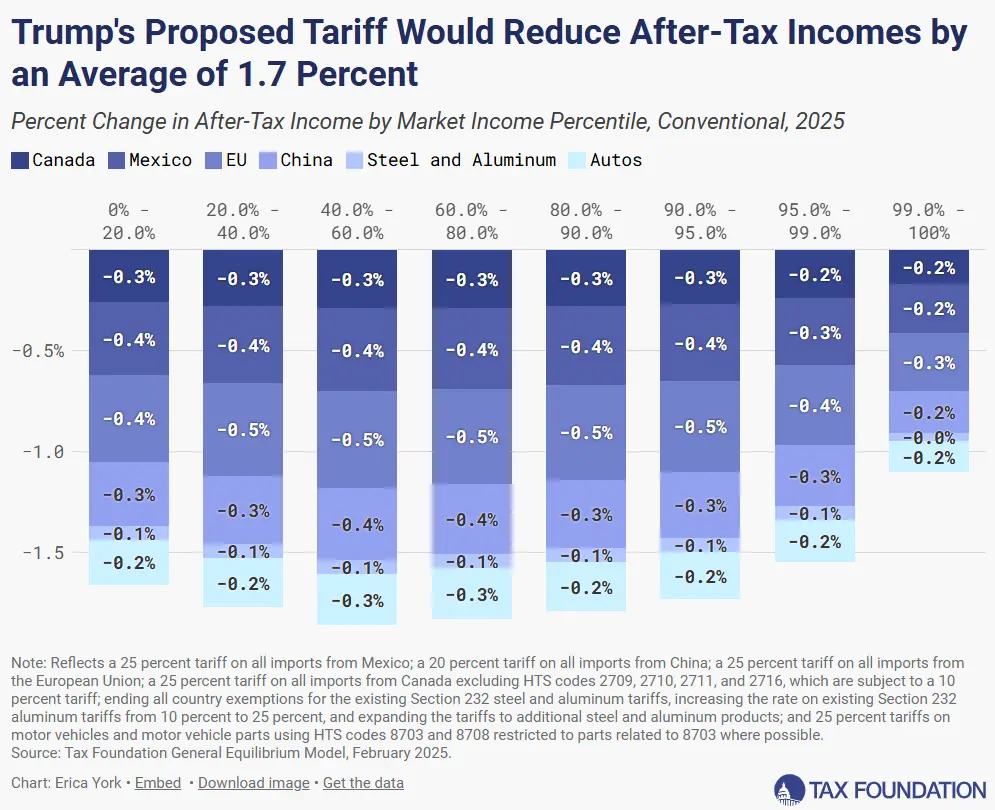

In addition to the direct cost increase, the tariff hike may also lead to decreased consumer demand in the U.S. market, impacting sales performance. According to UBS analysis, the U.S. GDP growth may decrease by 0.8 to 1 percentage points, and global economic growth will also be affected.

1.Tariff Policy Updates and Impact

1.1 Overview of Tariff Adjustments

- Electronics: Smartphones, laptops, tablets

- Household Items: Furniture, kitchenware, daily necessities

- Automobile Parts: Brake pads, engine components

Data References:

- U.S. Census Bureau: In 2024, the U.S. imported approximately $427 billion worth of goods from China, with consumer electronics representing the largest share.

- Consumer Technology Association (CTA): In 2024, China accounted for 78% of U.S. smartphone imports and 79% of laptop and tablet imports.

1.2 Specific Impacts

(1) Increase in Procurement Costs for Cross-Border Sellers Assuming tariffs increase from 10% to 25%, the trend in product cost increases is as follows:|

Product

Category

|

Original Tariff

(10%)

|

New Tariff

(25%)

|

Cost

Increase

|

|

Laptop ($1000) |

$100 |

$250 |

+$150 |

|

Smartphone ($800) |

$80 |

$200 |

+$120 |

|

Furniture ($500) |

$50 |

$125 |

+$75 |

(2) Decreased Demand and Shrinking Profit Margins

(3) Challenges in Supply Chain Adjustments

Shifting production to countries like Vietnam, India, and Mexico may face challenges such as:

- Inconsistent product quality

- Long supply chain integration time (3-12 months)

- Though tariffs may be lower, logistics and management costs could rise.

2、Widespread Impact on Global Trade and Supply Chains

The tariffs imposed by the U.S. on Chinese goods not only affect trade between the two countries but also have broader implications for global supply chains. Sellers who have traditionally relied on Chinese manufacturing are now facing increased procurement costs, pushing them to explore alternative sourcing options. Southeast Asia, India, and other regions are becoming increasingly attractive as new production bases to reduce dependency on China. This shift is part of a broader strategy to adjust to the new tariff environment, but it also presents challenges, such as quality control, integration times, and higher logistics costs.

In addition to these tariff increases, U.S. businesses will also need to prepare for potential tax changes in 2025.

2.1 Corporate Tax Rate Changes

- 2024: U.S. corporate income tax rate is 21%.

- 2025: The proposed increase to 28% (source: U.S. Treasury Department). Impact: Cross-border sellers with U.S.-registered businesses will face higher tax burdens.

2.2 Digital Services Tax (DST)

- 2025: The U.S. may introduce a digital services tax, targeting sales revenue on cross-border e-commerce platforms like Amazon, eBay, and Shopify, with a tax rate of 2%-5% (source: OECD Tax Report). Impact: Sellers using these platforms will face higher operating costs.

2.3 Combined Impact of Tariffs and Taxes

- Overall Tax Burden Increase: The combined effect of higher tariffs and tax policy adjustments will further squeeze cross-border sellers' profit margins.

- Cash Flow Pressure: Higher tariff and tax costs could lead to short-term cash flow issues, especially for small and medium-sized sellers.

3、Response Strategies for Cross-Border E-Commerce and Trade Sellers

3.1 Supply Chain Optimization Strategies

(1) Supplier Diversification to Reduce Reliance on China

- Growth in Vietnamese Manufacturing: In 2024, Vietnam's electronics exports grew by 11.2%, with mobile phones and components accounting for $58.9 billion (source: Vietnam Ministry of Industry and Trade).

- Advantages of Mexican Manufacturing: In 2024, U.S. imports from Mexico reached $460 billion, surpassing China (source: U.S. Department of Commerce).

Specific Measures:

- Use platforms like 1688, Global Sources, JITGalaxySource to find factories in Southeast Asia and Mexico.

- Work with third-party sourcing agents to vet new suppliers.

- Adopt a small-batch testing + long-term collaboration model to ensure stable supply.

(2) Optimize Logistics to Reduce Warehousing and Transport Costs

- Cross-Docking: This is suitable for sellers on platforms like Amazon, Walmart, etc., allowing direct shipments from China/Vietnam to U.S. warehouses, reducing storage costs.

- FBA Inventory Management: Adopt Just-in-time (JIT) inventory models to minimize warehousing fees.

3.2 Price Strategy Optimization

(1) High-Profit Product Strategy

- Increase the proportion of high-margin products, such as electronics from brands like Apple and Sony, or customized products like personalized phone cases and accessories.

- TikTok Shop Marketing: In 2024, TikTok Shop sellers' prices were 15%-20% higher than Amazon, yet their sales still grew (source: Marketplace Pulse).

(2) Off-Peak Purchasing + Bulk Negotiation

- Off-Peak Procurement: Data shows that the import peak season is from September to January, with transportation costs being 15%-25% higher during this period. Cross-border sellers can avoid peak season to reduce costs.

- Negotiation with Suppliers: Leverage long-term collaboration advantages to secure better wholesale prices.

3.3 Leveraging Tariff Exemptions and Tax Optimization

- HTS Classification for Tariff Optimization: Some products can reduce tariffs by being reclassified.

- Apply for U.S. "90-Day Tariff Deferral" Policy: Alleviate short-term cash flow pressure.

- Register Companies in Low-Tax Regions: Registering in regions like Hong Kong or Singapore can optimize global tax structures.

- Monitor Digital Services Tax Exemption Policies: Some small sellers may qualify for exemptions and should apply in advance.

4、Additional Data and Suggestions:

- According to the U.S. International Trade Commission (USITC), the 2025 tariff hikes may lead to a 15%-20% reduction in Chinese exports to the U.S. Sellers should prepare to diversify their supply chains in advance.

- Sellers should strengthen collaboration with local distributors and explore B2B models to reduce tariff and logistics costs.

- Utilize the Regional Comprehensive Economic Partnership (RCEP) to shift some production to member countries (e.g., Vietnam, Thailand), benefiting from lower tariff rates.

5、How can JitgalaxySource help with you?

Here are the key services provided by JitgalaxySource:

Supply Chain Management

Logistics & Warehousing

Procurement Agency

Tariff & Tax Optimization

Market Strategy & Branding

Data-Driven Decision Support

Trade Compliance & Legal Consulting

6、Conclusion

Read More

- Buy from 1688 China in Nigeria with Free Shipping Azambe Lagos Wholesale & Retail Guide

- How to Import Goods from China to Nigeria (Step-by-Step Guide)

- Trusted Certified Second-Hand Medical Equipment in Nigeria

- Importing from China to Nigeria Made Simple with AZAMBE App

- How to Import from China to Nigeria and Start a Profitable Business- 2025 Guide Even From Just 1 Pcs

- How to Import from China to Nigeria and Start a Profitable Business

- Why China Wholesale Markets Dominate Global B2B Sourcing in 2025

- Top 10 Cross-Border E-Commerce Platforms in 2025: Trends, Insights & Sourcing StrategyTrends

- Nigerian How to Use 1688 as Local

- Facing Customs Detention? Fast-Track Solution for B2B Importers

FAQs to Help You Get Started with JITgalaxySource

1.What products can I source from JITgalaxySource?

We offer a wide range of products, including electronics, fashion, home goods, and customized OEM/ODM options.

2.How does JITgalaxySource ensure supplier reliability?

We work exclusively with verified suppliers to guarantee quality and trustworthy partnerships.

3.What are the logistics options available?

JITgalaxySource provides comprehensive logistics solutions, including international shipping and customs clearance.

4.Can I order in small quantities?

Yes, we support low MOQ sourcing to cater to businesses of all sizes.

5.Does JITgalaxySource offer product customization?

Absolutely! We provide OEM and ODM services to meet your specific product needs.

6.How secure are the transactions?

Absolutely! We provide OEM and ODM services to meet your specific product needs.

7.Can JITgalaxySource help with cross-border trade challenges?

Yes, our experienced team helps businesses navigate language barriers, cultural differences, and regulatory requirements.

8.How do I get started on JITgalaxySource?

Simply submit our inquiry form to explore product categories and connect with our sourcing experts!

Get Your Free Sourcing Quote Now!